Excellent member experience

Annual Report 2023

STRATEGIC THEME:

Excellent member experience – progress in 2023

SUMMARY:

Member experience is much more than just ‘customer service’. We care about how our members feel and interact with us and the value they attribute to their membership. A positive member experience promotes the retention of existing members, increases the recruitment of new members and will expand the Institute’s reach across the insurance and personal finance professions. In short, an excellent member experience will have a direct impact on our success in financial and non-financial terms. Over the next five years we will embed practices that ensure we provide an excellent member experience for every individual member and corporate client across all touch points. We will build five pillars to ensure all existing and prospective members receive the highest quality support and service from the outset of their membership journey.

Member experience is much more than just ‘customer service’. We care about how our members feel and interact with us and the value they attribute to their membership. A positive member experience promotes the retention of existing members, increases the recruitment of new members and will expand the Institute’s reach across the insurance and personal finance professions. In short, an excellent member experience will have a direct impact on our success in financial and non-financial terms. Over the next five years we will embed practices that ensure we provide an excellent member experience for every individual member and corporate client across all touch points. We will build five pillars to ensure all existing and prospective members receive the highest quality support and service from the outset of their membership journey.

COMMENTARY:

Reflecting on the CII’s performance against the plan’s actions and KPIs in 2023, Mark Hutchinson, Membership Director, commented:

“We have made great progress in 2023 in improving the member experience and therefore the value gained from membership.

In June, for example, we published an overview of key member events and other engagement activities that were planned for the second half of the year. This was part of a broader focus on raising awareness of the various features and services that membership unlocks, as well as reinforcing the core benefits of membership, being: credibility, community and career. We were also aware that we needed to improve the onboarding process for new and returning members, therefore in October we held our first interactive

‘welcome’ webinar to help them navigate their membership services and answer queries. This was part of an enhanced onboarding programme designed to help new members quickly find the content most relevant to their needs and career stage. Live and interactive welcome webinars are now delivered quarterly.

One of the main actions from the Strategic Plan was to increase the range of communication channels we use to reach members. Whilst email remains our primary communication channel, we also began to promote key activities through LinkedIn and other social media. We are evaluating more engaging digital community platforms to facilitate active communities for our UK and international members, as well as platforms such as WhatsApp Business and WeChat as potential enhancements.

We have started a review of our membership proposition to determine how it can be enhanced to deliver maximum value for current and future generations of professionals working in the insurance and personal finance sectors. As part of the review, we will engage with members and other key stakeholders to seek their views and input.

We know through our latest Public Trust Index research that consumers who use an insurance broker believe that the service they receive is better than the aggregate, which includes purchasing products through banks and building societies, or online.

Our local institute network is critical to our ability to deliver activities aligned with the CII’s strategy. The ‘Realigning the Partnership’ initiative was launched at the June 2023 Network Conference, with an objective to review the current relationship between the CII and the local institute network in order to further support our 800 volunteers across the UK to enable them to develop the local membership proposition. A questionnaire was sent to all local institutes in August 2023 asking how they wanted it to develop, and what support they would require. 90% responded and feedback has shaped an initiative which covers nine key

themes, from CPD delivery through to council support, which has been developed in consultation with the Local Institute National Forum and rolled out during 2024. Aligned to this, a volunteer network management strategy was approved by the Board in October 2023, and we began consultation in 2024.

There were IT issues that affected member interaction with the CII during 2023. We understand how frustrating this can be and are very grateful for our members’ patience. However, the successful delivery and introduction of our new CRM system has improved our understanding of our customers’ and members’ needs, allowing us to gain more insight, and tailor contact and services better, according to sector, specialism and career stage.

Given all the factors affecting the CII during 2023, it was highly encouraging to see that membership, event participation and NPS all grew at an underlying level during the year. Our membership rose to 120,000, suppressed beneath our target of 122,000 by data cleansing of inactive members as part of our IT upgrade. Event participation rose 1% and our CII Group Member NPS score in Q4 2023 was +22, up 5 points on the Q2 2023 outturn.”

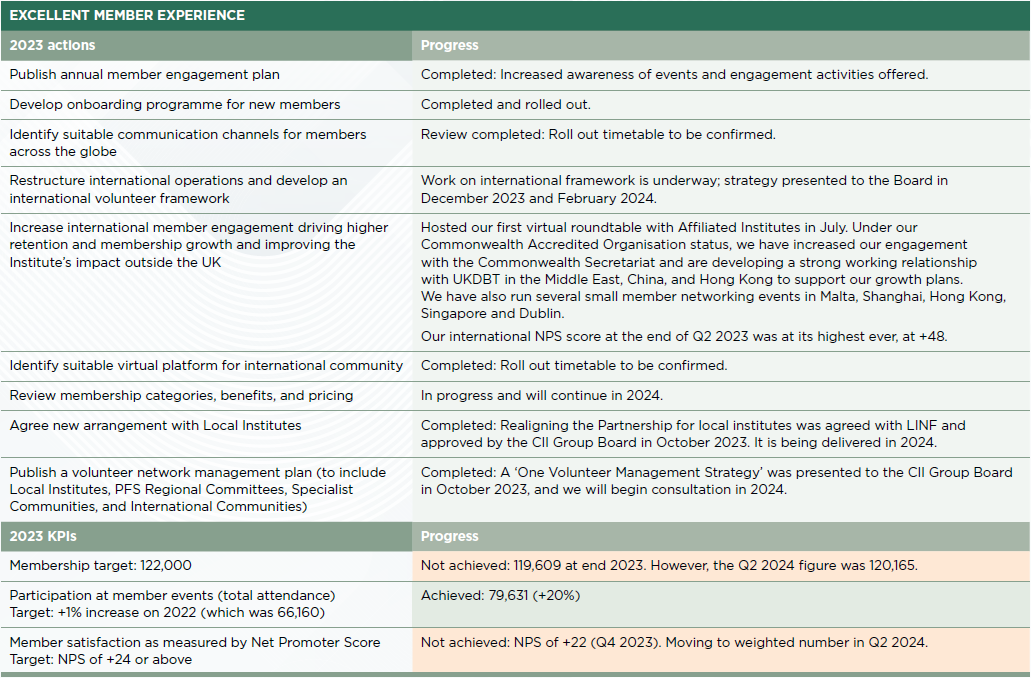

PERFORMANCE: