Sector thought leadership

Annual Report 2023

STRATEGIC THEME:

Sector thought leadership – progress in 2023

SUMMARY:

The Institute is uniquely placed to inform and influence strategic thinking across the insurance and financial planning professions both in the UK and around the world, drawing on the expertise within our organisation and that of our members. In recent years, the Institute has contributed to bringing fresh talent into our professions by informing the Government’s trailblazer apprenticeships and through our New Generation programme, which has been running for more than a decade. We’ve helped our members to navigate the challenges presented by Brexit and the COVID-19 pandemic. We’ve led the way in building understanding around issues of evolving sectoral importance, including data science and AI through bespoke events and the development of innovative programmes of learning. In addition, we’ve galvanised sector support to commitments around ethical conduct, continuing professional development, qualification standards and to pay and equal opportunities, especially through the Insuring Women’s Futures programme. All of

these initiatives have helped us to further our Chartered objective around building public trust in insurance, personal finance and mortgage advice.

Our focus will be on continuing to help members navigate the introduction of new regulations, such as the Financial Conduct Authority’s Consumer Duty. In addition, we will ensure we are highly regarded among policymakers internationally for the expertise and professionalism the Institute possesses and demonstrates through its work and the actions we and our members take. So, we will be proactive in every conceivable way to influence policy formation and thinking on any matter that affects our mission. But it will also mean ensuring our members fulfil their obligations to us and the public. For example, we will opine on matters related to increasing consumer empowerment, securing the highest degrees of professional competence among our members, and ensuring corporate members are effectively and equitably mitigating consumer risk.

COMMENTARY:

One of our priorities in the year was to better promote the rich data we already collect in respect of the public perceptions of trust in our professions and the value of Chartered status, so that they are widely shared, understood and utilised. Our Public Trust Index is structured around customer outcomes, and includes questions about how confident people are that their insurer is going to pay out, questions about how familiar they are with how to complain, and whether they believe that they’ve got the right level of protection. We took an active decision in 2023 to promote the findings more widely on social media and encouraged the general press to report them.

The FCA’s new Consumer Duty requirements are also very much outcomes-based. As such, we had the ability to inform our members that not only did the FCA say they had to deliver these outcomes for Consumer Duty compliance but they are also what customers are saying is critical to building public trust through our index. So, we can support the fact that the FCA is not just seen as operating in an ivory tower but is promoting actions that are beneficial to consumers.

In the year, we also strived to ensure our members remained leaders among their peers in relation to professionalism and standards through the identification of, and need for, high-quality Continuing Professional Development. We supplemented this focus through the production and dissemination of relevant good practice and companion guides to our code of ethics. This included a guide on Environmental, Social and Governance (ESG), sometimes known as ‘green finance’ for all our members; another ESG guide specifically for brokers; and an ESG guide for SME brokers produced by one of our New Generation programme teams. We also produced guides on AI safeguards, governance processes, and how to treat third parties.

We also sought to conduct more original research and instil an innate curiosity among our colleagues as part of an organisational endeavour that would enable us to better answer important sectoral questions and speak with authority on a wider range of matters. We looked to engage with our members in relation to topics that could deliver real insight and drive positive outcomes for consumers, with two of the groups in our New Generation Programme producing highly insightful work:

- The New Generation Claims group reflected on the mental health of people working in claims, and best practice from other occupations that are affected by traumatic events, such as the emergency services, that have ways of dealing with this over and above a standard counselling line. We’ve had interest from the ABI as a result of this report and a large amount of feedback saying that it’s one of the best pieces of work in thought leadership that’s come out of insurance in a long time.

- The New Generation Broking group created the Insurance Influencer campaign with the aim of making a positive impact on the general perception of insurance careers. The campaign video and accompanying digital flyer demonstrate the exciting and diverse range of opportunities that exist within the industry, to assist recruitment activity and the promotion of careers across the sector. The video and digital flyer are intended as tools to support the industry, and have been made freely available for download, to be used in any activity that may be deemed valuable to the insurance sector.

We have sought to engage with our members at a series of events during the year, a selection of which we highlight below:

- Shaping the future conference – in September 2023, we looked at why resilience is fundamental within the insurance profession. Further sessions explored both ESG and the impact of flooding and other natural disasters, before a panel discussion on how we can build partnerships for community resilience.

- President’s Dinner – Russell Higginbotham, CII President and CEO, Swiss Re Solutions, hosted the first President’s Dinner since the pandemic in November 2023 with a keynote speech from Economic Secretary to the Treasury and City Minister, Bim Afolami MP.

- President’s breakfasts – Russell also hosted two breakfasts during the year designed to bring senior leaders together from across the insurance and financial services professions to cultivate discussion and thought leadership. The first one of which, in May 2023, was addressed by Andrew Griffith, at the time the Economic Secretary to the Treasury and City Minister, who spoke about how the insurance sector had shaped the City of London over time and discussed the work the government is undertaking to “compete in this new world with speed and agility”. The second in September was addressed by Lloyd’s Chairperson, Bruce Carnegie-Brown, and focused on the three main challenges for the insurance industry as he saw them: cost, confidence and relevance.

- Local institute dinners – in addition, CII Board Members and CII senior management attended numerous local institute dinners during the year. The dinners provide an opportunity for local institutes to celebrate their achievements, engage with members and local companies, and promote their own key objectives.

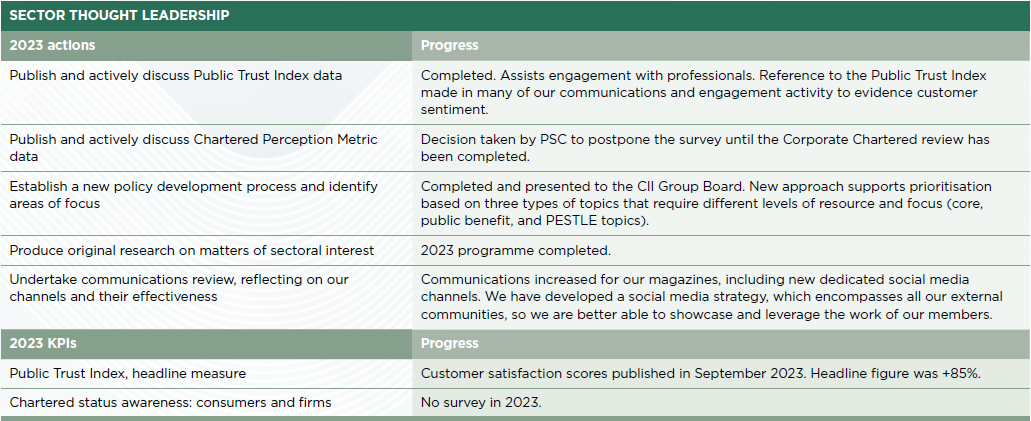

PERFORMANCE: