Highest professional standards

Annual Report 2023

STRATEGIC THEME:

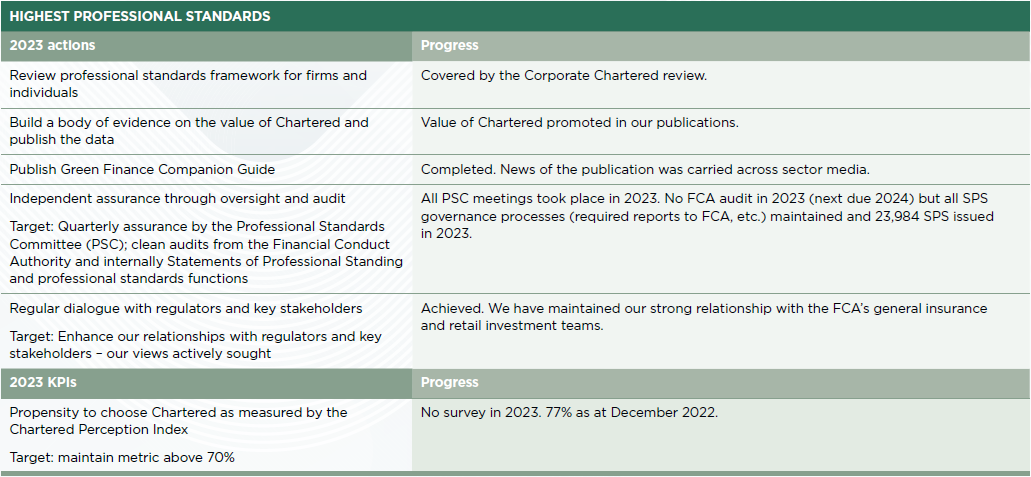

Highest professional standards – progress in 2023

SUMMARY:

Professionals work in uniquely challenging environments. Having chosen to pursue careers where they are regarded as especially qualified, they are subject to high expectations of ethics and conduct and hold positions of public trust. CII and PFS members go above and beyond the regulatory minimum by striving for professional excellence and by committing to uphold the CII Code of Ethics. They demonstrate competence by undertaking an annual minimum of 35 hours Continuing Professional Development (CPD) and, through membership of the CII and PFS, sign up to a process which holds them to account should these exacting standards not be met. All retail investment advisers are issued with their Statement of Professional Standing (SPS).

Setting and maintaining the highest professional standards is a core activity for a professional membership body. In general, the standards that we set for our collective professions and members is higher than the minimum threshold standards set by the relevant regulators though the purpose is common – we do so to provide public trust and confidence in the profession and the sector.

Recognising the esteem with which UK professional membership bodies are held overseas, our ambition is to become more influential on the development of professional standards for the insurance and financial planning sectors internationally, working directly with regulators in overseas jurisdictions and in collaboration with the Institute’s International Affiliated Institutes.

COMMENTARY:

Liam Russell, Legal Director and General Counsel, who has interim responsibility for progressing the “highest professional standards” strategic theme during 2023, commented:

“We have made good progress in this area during the reporting period.

One of our roles is to provide independent assurance through oversight and audit. Around 2,300 SPS holders were selected for CPD audit in 2023 and all members successfully renewed, with no certificates revoked due to non-completion of CPD.

The CII has a specific CPD tool which allows members to track and record their CPD on an ongoing basis. Its functionality was updated in October 2023 to include a designated ‘ethics’ category, reflecting a new requirement that we introduced for our members for 10% of their CPD activities to be related to ethical practice. This reinforces the benefit of enhanced CPD on customer outcomes. Alongside this activity, we initiated an in-depth review of our entire CPD process in order to ensure we were delivering appropriately for our members and their customers. New rules and supporting guidance will be introduced in due course.

We began a review of our Corporate Chartered Status rules in 2023, to make sure we are driving the right outcomes and not limiting the potential for firms to grow and succeed. This will report in 2024. Allied to this is our work to build a body of evidence that demonstrates the value of dealing with CII and PFS qualified professionals. It is encouraging to note that when we last ran the Chartered Perception Index in 2022, 77% of respondents indicated that they were more likely to choose a Chartered firm as opposed to one without Chartered status. In 2019, the CII made it a requirement for firms to have an equality, diversity and inclusion

(EDI) policy in place in order to achieve Corporate Chartered status. The CII also committed to measure the impact of such policies, and create best practice guidance around EDI. We conducted a Chartered EDI survey in March 2024 that demonstrated that firms who implemented EDI practices and policies have seen positive outcomes for their business. Such change will allow firms to be ahead of the curve when the FCA’s proposed consultation on EDI is completed.

Professionals are often at the cutting edge of change in our lives, leading the way and setting examples for others to follow. One of the greatest needs of our time is to make sustainable choices for the future, and be mindful of protecting our environment and natural resources. We published the Green Finance Companion Guide in March 2023, which sought to help insurance and personal finance professionals understand their responsibilities when it comes to their duty to act ethically, and learn about how they can make a difference day to day to meet the needs of the planet, as well as the needs of their clients.

Our aim is to produce a greater number of reports on sectoral issues and the state of the professions. We intend to publish more articles on professional standards topics in 2024, alongside a new Professional Standards Committee report.

We have sought to enhance our relationships with government and regulators through regular contact, using meetings to discuss and promote professional standards across our sectors.”

PERFORMANCE: